About Lesson

In this lesson, we are going to discuss the following topics:

- Linkage of grouping to the respective schedules

- Grouping account to desired categories

- Wrong grouping and regrouping function

- Create new expenses item

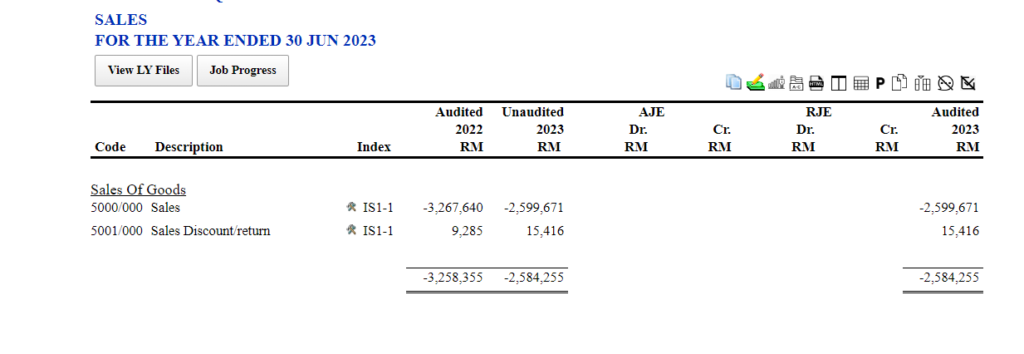

Linkage of grouping to the respective schedules

Sch types – lead schedule

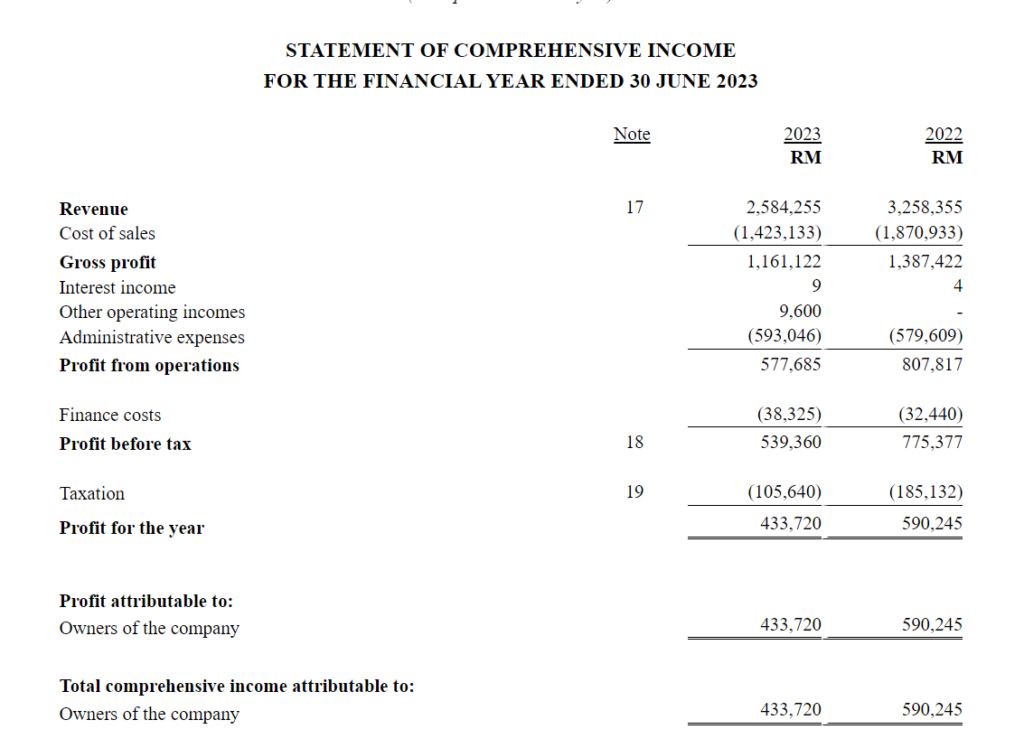

Report type – Income statement/balance sheet

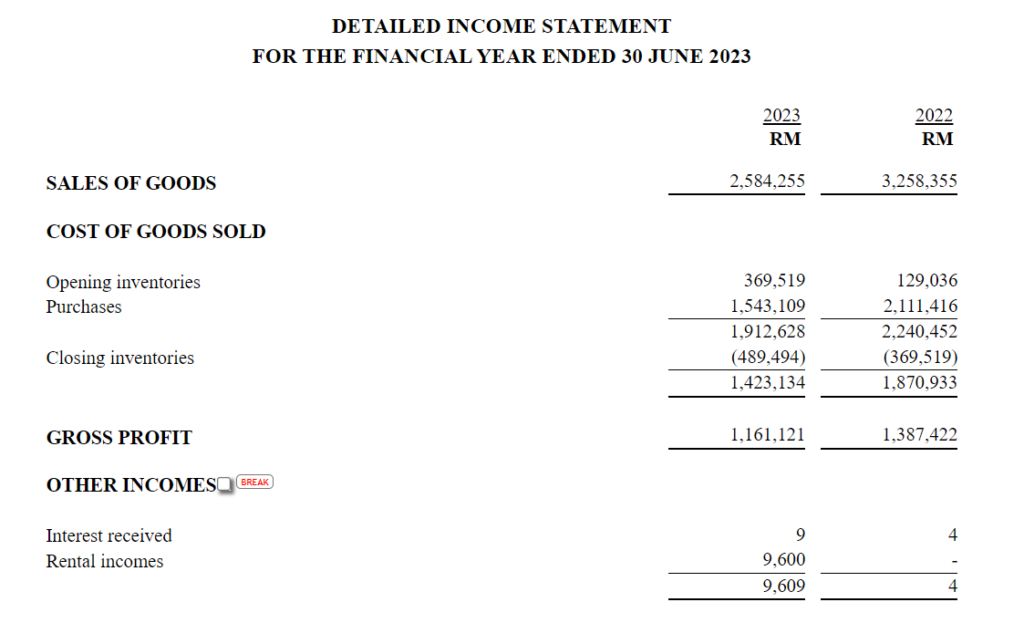

Management account – detail income statement/financial instrument

Note line item – Note to financial statement

Grouping of account to desired categories

- Navigate to menu Grouping>Group TB to reporting item

- Assign each of the trial balance item to their respective categories.

- Click OK to save single item, while click Next 20 to save multiple item at once.

Wrong grouping and regrouping function

- Navigate to menu Grouping>View Grouped Item

- Tick on the checkbox for those transaction with wrong category

- Scroll down the page and click Delete Records

- Revert back to the menu Group TB to reporting item for reassignment

Create new expenses item

- Lets say there is an expenses item called special expenses which cant find any suitable description to perform grouping.

- To create the new item, navigate to menu Grouping> Create management account item

- Click on Add record

- Enter the following information:

Reporting code: Administrative Expenses

Report item description: Special expenses

- Click on Add new record to save the new description for expenses.

- Now the description is available for grouping at the page Grouping>Group TB to reporting item