About Lesson

In this lesson, we will cover the topics stated:

- Audit Adjustment/Reclassification

- Prior Year Adjustment (PYJE)

Audit Adjustment (PAJE)

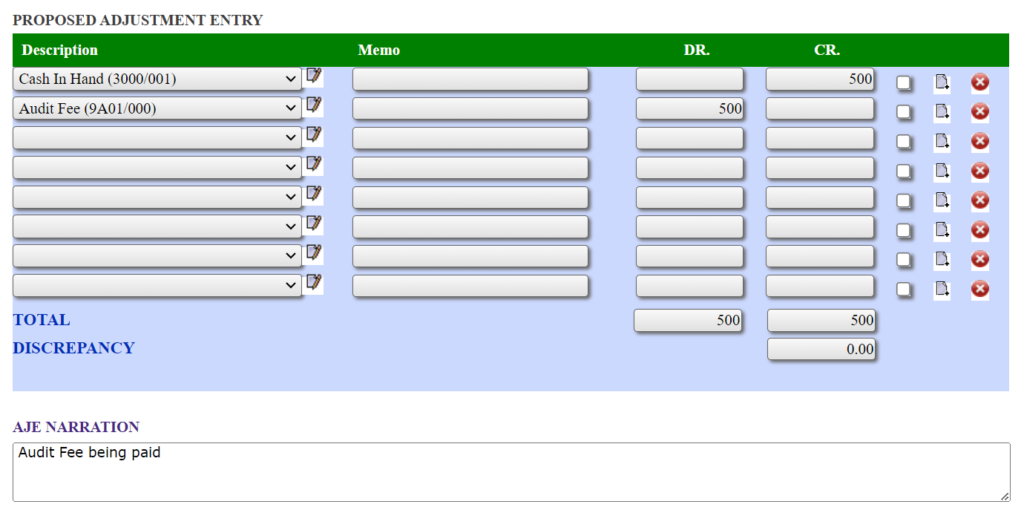

An audit adjustment is passed during the year with the following double entry:

Dr RM500 – Audit Fee

Cr RM500 – Cash in hand

- At the lead schedule, navigate to menu Process>PAJE PRJE PYJE

- Type of adjustment: Select PAJE

- Enter the adjustment together with AJE narration

- Click on the Save button.

- The adjustment worksheet could be view at schedule

- F-4 for PAJE

- F-5 for PRJE

- F-6 for CAJE

Prior Year Adjustment (PYJE)

Prior Year Adjustment is performed due to change in accounting policy or accounting error.

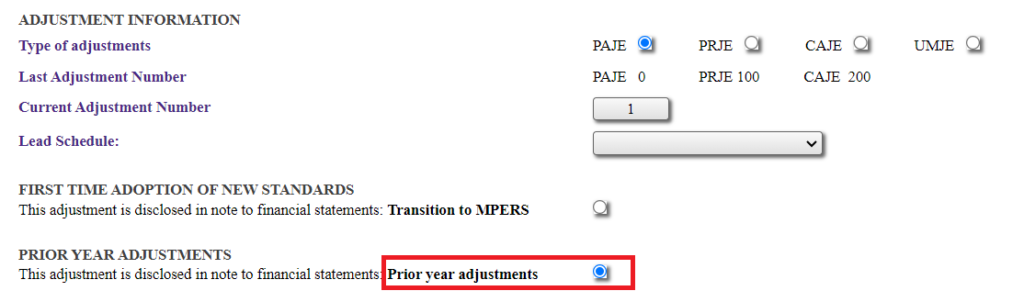

- At the lead schedule, navigate to menu Process>PAJE PRJE PYJE

- Check the box for Prior Year Adjustment

- Select the year end which the adjustment should be made.

- Select the category of prior year adjustment such as De-recognize items from assets and liabilities or Re-classify assets and liabilities etc.

- Enter the audit adjustment and the description of the adjustment, similar to PAJE.

- Click on the Save button.